Project profile

Beetaloo: Fracking the heart out of Australia

Australia is on the precipice of letting rip on an enormous new fracking project in the heart of Australia’s Northern Territory, the Beetaloo Basin. Despite being incompatible with a safe climate, Australia’s biggest banks are funding the companies vying to detonate this climate bomb.

Add your name to the open letter and join thousands of Australians calling on the banks to stop funding the companies working to detonate the Beetaloo carbon bomb!

Take Action

Join the open letter to ANZ, Commonwealth Bank, Macquarie Bank, National Australia Bank and Westpac

You can find the full text of the open letter linked on this webpage. Your name will be added in the form [first name] [first initial of last name] (e.g. John S.).

What is Fracking and why are Australians worried about it?

Fracking is a high-risk gas exploitation method which involves injecting water, sand and hazardous chemicals deep underground to break up pockets of gas and allow it to seep to the surface. Fracking is notorious for contaminating water systems and agricultural land and has devastated local communities and ecosystems in the United States. Fracking poses such severe environmental and health risks that the practice has been banned in Victoria, Tasmania and in 15 other countries worldwide.

Methane gas on fire. Image credit: Jeremy Buckingham

A recent survey by YouGov has found there is significant opposition to gas fracking in Australia with a majority of Aussies believing that gas fracking is harmful for the environment, and brings more problems than benefits to local communities.

The Beetaloo Basin

As a new gas field, Beetaloo is not compatible with limiting global warming to 1.5°C in line with the Paris Agreement. If Beetaloo proceeds at full-scale, as the gas companies intend, Beetaloo would become Australia’s largest and highest emitting gas field, operating until almost 2070. Burning the gas reserves from Beetaoo would produce an estimated 1.1 billion tonnes of CO₂-equivalent, equal to Australia’s largest coal plant, Eraring, operating for more than 83 years.

Beetaloo is a climate bomb Australia and the world cannot afford to detonate.

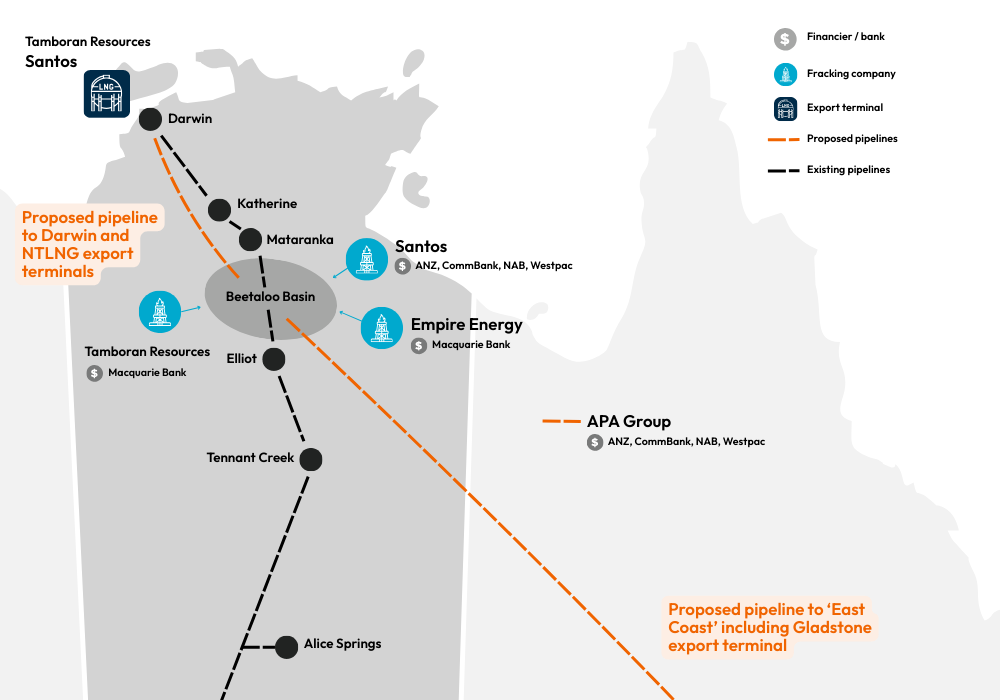

The project’s main proponents, Empire Energy and Tamboran Resources, are currently progressing through exploration and pilot production phases, anticipating initial gas as early as this year (2025). Pipeline developer APA Group is planning to construct several pipelines to support extensive fracking. One of Australia’s biggest oil and gas companies Santos, also has a stake in Beetaloo with plans to start its drilling program in 2026.

Australian banks are backing the Beetaloo gas barons

Australia’s big banks are funding the companies hell-bent on fracking Beetaloo, despite their claimed commitments to the goals of the Paris Agreement.

Macquarie Bank

- Macquarie is a substantial shareholder of Empire Energy and has also been financing the company for the past 15 years. In November 2024, Macquarie pulled together a $65 million financing package explicitly for Empire Energy’s gas fracking operations in the Beetaloo Basin. That’s over one third of the value of the entire company.

- Macquarie also recently provided a $35 million loan to Tamboran Resources to “support [Tamborans’s] ongoing development activities,” all of which are focused on exploiting Beetaloo gas.

ANZ, Commonwealth Bank, NAB and Westpac

All four major Australian banks finance APA Group – the nation’s largest gas pipeline operator and a key enabler of fracking in the Beetaloo Basin.

In June and August 2023, APA Group signed preliminary agreements with the leading developers of the Beetaloo Basin, Empire Energy and Tamboran Resources, to construct pipelines that would enable the Beetaloo to be opened up and exploited.

Since APA signed agreements with the Beetaloo developers, Australia’s biggest banks have been involved in multiple deals with APA.

- In November 2023, ANZ, CommBank, NAB and Westpac all took part in a $1.25 billion loan to APA Group. ANZ, CommBank and NAB loaned $50 million each, while Westpac loaned $80 million. While part of this loan was to fund APA’s acquisition of Alinta Energy’s existing Pilbara gas assets, it will also be used for ‘general corporate purposes’.

- In November 2023, ANZ and Westpac also acted as ‘Co-Managers’ for a $835 million bond issued by APA Group.

- In September 2024, APA issued a $1.9 billion bond, with ANZ, Commonwealth Bank and Westpac underwriting $28 million each according to an Offering Memorandum from the company.

The third Beetaloo fracker, Santos, is also a long standing client of each of the big four Australian banks.

Add your name to the open letter and join thousands of Australians calling on the banks to stop funding the companies working to detonate the Beetaloo carbon bomb!

Cover image: Santos flaring on Tanumbirini Cattle Station in the Northern Territory. Credit Original Power

Join us

Subscribe for email updates: be part of the movement taking action to protect our climate.